GST Handbook for Legal Practice

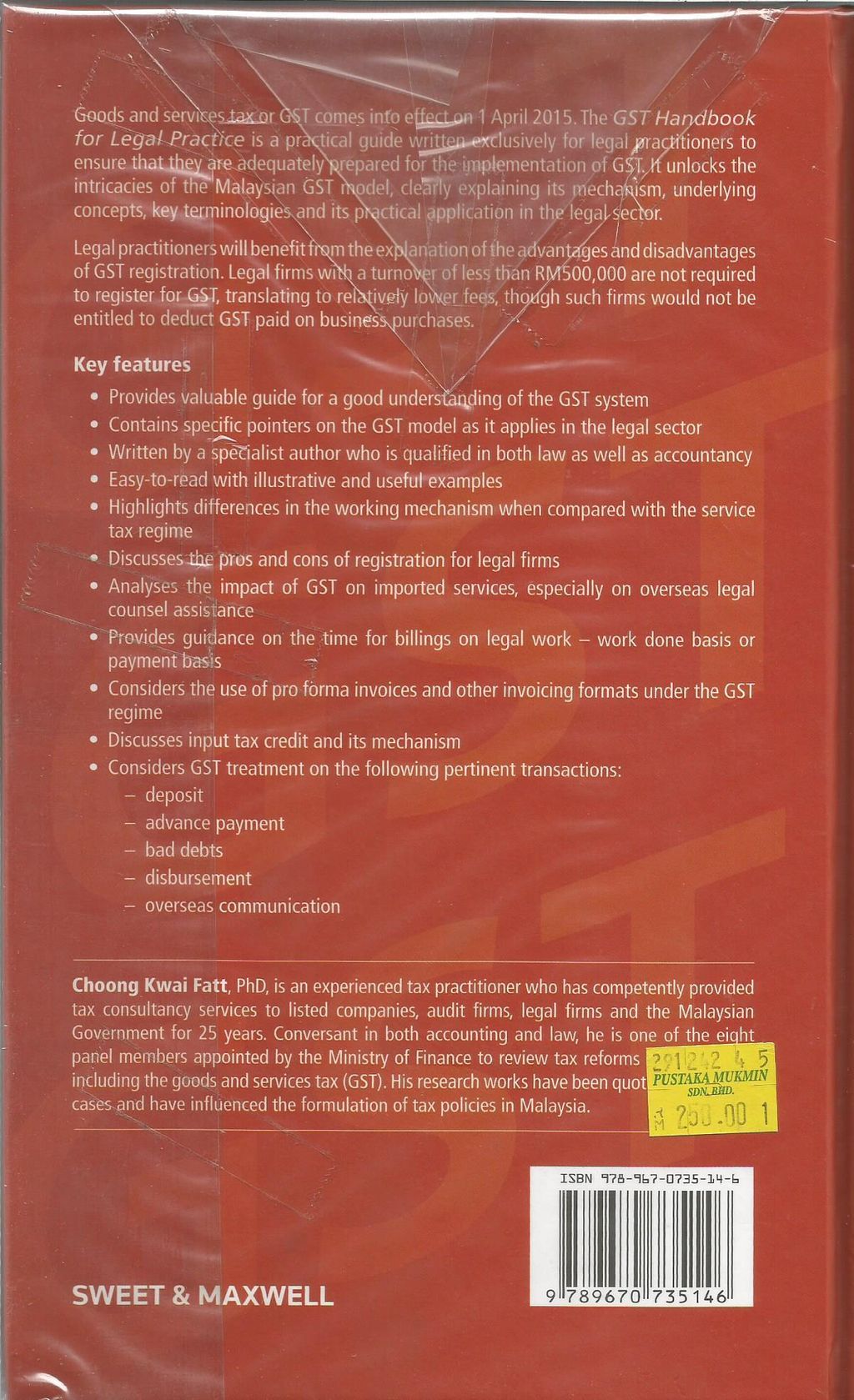

The goods and services tax or GST comes into effect on 1 April 2015. The GST Handbook for Legal Practice is a practical guide written exclusively for legal practitioners to ensure that they are adequately prepared for the implementation of GST. It will unlock the intricacies of the Malaysian GST model, clearly explaining its mechanism, underlying concepts, key terminologies and its practical application in the legal sector.

Legal practitioners will benefit from the explanation of the advantages and disadvantages of GST registration. Legal firms with a turnover of less than RM500,000 are not required to register for GST, translating to relatively lower fees, though such firms would not be entitled to deduct GST paid on business purchases.

Please refer to the images for a summary/synopsis of the book.

Sila rujuk kepada gambar halaman belakang buku untuk membaca ringkasan buku tersebut.

Customer comments

| Author/Date | Rating | Comment |

|---|